Meanwhile, federal Treasurer Jim Chalmers has said the drop in annual inflation occurred under Labor.

Australia’s worse-than-expected inflation data in the March quarter could pose a challenge for the federal budget, according to analysts.

Inflation increased by one percent in the March quarter, up from a 0.6 percent increase in the December quarter, ABS statistics show.

Despite this, Federal Treasurer Jim Chalmers still touted figures showing annual inflation has dropped under Labor.

However, Shadow Treasurer Angus Taylor claims Australians are paying a high price for the government’s “economic mismanagement.”

Deloitte Access Economics partner Stephen Smith said the treasurer would be treading a tightrope with price pressures lingering and growth subdued.

“(March quarter inflation data) underscores the difficulty of the high-wire act the treasurer must perform when handing down the budget next month, balancing the need to provide cost of living relief for households while positioning the Australian economy for a pivot to growth after months of inertia,” he said in quotes cited by AAP.

Deloitte predicted the Reserve Bank of Australia (RBA) will cut rates in November this year in a business outlook report published on April 23, one day before the latest inflation figures were released.

Chalmers Will Balance Inflation Flight with Economic Growth in Budget

Federal Treasurer Jim Chalmers acknowledged inflation is still too high and said the budget in May will focus on easing cost of living pressures, not adding to them.

“In the May Budget, the Albanese Government will seek to balance the ongoing fight against inflation with the need to gear our economy for growth,” Mr. Chalmers said.

“The centrepiece of the cost‑of‑living help in the Budget will be a tax cut for every taxpayer. We will consider additional help on top of that if it’s affordable, if it’s responsible and if it helps takes some of the edge off inflation in our economy.”

Mr. Chalmers said the government is aiming to deliver a second surplus in the May federal budget. He said this “responsible fiscal management” will allow the government to pay down debt and make room for other priorities.

Opposition Calls for Reduction in Spending in Budget

However, Mr. Taylor suggested the government needs to rein in spending in the federal budget, which could cause more pain.

“There is a better way. A back to basics agenda that manages government spending, that makes sure there isn’t waste—$209 billion of extra spending since Labor came to power, over $20,000 for the average Australian household,” Mr. Taylor told reporters during a media doorstop.

“And the Treasurer is now out there telling us he’s going to spend more. He’s making very clear signals that that’s his intention in this budget, he’s going to spend more and that drives up inflation and interest rates. That puts more pain onto Australian households.”

The Shadow Treasurer suggested several measures he would like to see implemented, including reducing red tape and approving critical projects.

“As I say, there’s a better way, making sure that we’ve got the competitive, productive workplaces that we need, not handing over our workplaces to union officials,” Mr. Taylor said.

“Making sure we’re getting rid of the red tape, approving critical projects, making sure that Australians get the energy price reductions that they were promised the $275 and there’s absolutely no sign of that appearing.”

Meanwhile, ANZ senior economist Catherine Birch said inflation will need to slow in the second quarter of 2024 for Reserve Bank of Australia rate cuts.

“We think the RBA will want to see a couple of quarters of lower non-tradables and services inflation to be convinced that overall inflation will not only return to the two to three percent target band but remain there,” she said in a research note.

“As such, non-tradables and services inflation will need to slow materially in quarter two for rate cuts to begin at the November meeting.”

What Did the ABS Data Reveal?

Data from the Australian Bureau of Statistics (ABS) showed that while CPI rose one percent in the March 2024 quarter, it increased just 3.6 percent annually.

“Annually, the CPI rose 3.6 percent to the March 2024 quarter. While prices continued to rise for most goods and services, annual CPI inflation was down from 4.1 percent last quarter and has fallen from the peak of 7.8 percent in December 2022,” the ABS said.

Education, health, housing, food, and non-alcoholic beverages were the greatest contributors to CPI increases in the March quarter.

For example, tertiary education costs soared 6.5 percent due to annual CPI indexation being applied to tertiary education fees.

Secondary education also soared 6.1 percent, while preschool and primary education lifted 4.3 percent at the start of the school year.

Medical and hospital services fees also hiked 2.3 percent amid GP’s and health service providers increasing consultation fees.

Rent costs also rose 2.1 percent, while new houses purchased by owner-occupiers increased by 1.1 percent.

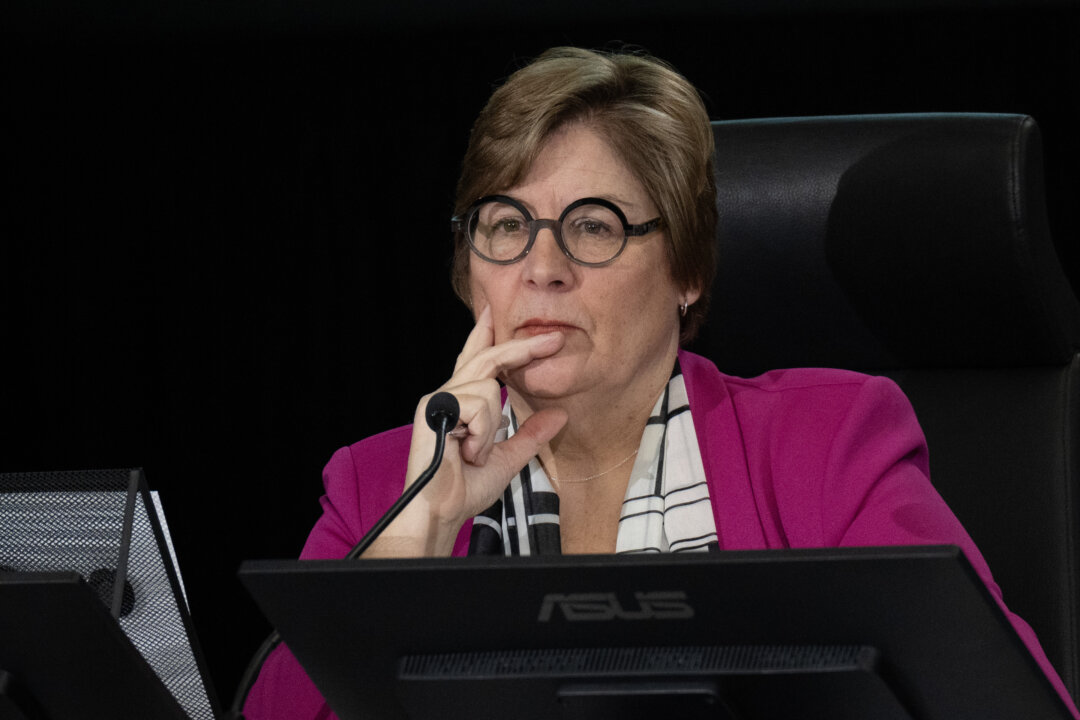

“Rental prices rose 2.1 percent for the quarter in line with low vacancy rates across the capital cities. Rents continues to increase at their fastest rate in 15 years,” ABS head of prices statistics Michelle Marquardt said.

Non-alcoholic drinks also lifted 3.4 percent, fruit and vegetables rose 2.5 percent, and other food products lifted 1.9 percent. However, meat and seafood prices slid by 0.7 percent.

The ABS statistics head added, “Meat and seafood prices fell this quarter as increased supply and discounting led to price drops for beef and veal and lamb and goat. Discounting of Fish and other seafood, and other meats also contributed to the fall.”

English (US) ·

English (US) ·  Turkish (TR) ·

Turkish (TR) ·